Tax law and legal structures

Australian not-for-profit tax law is very, very complicated. The exact situation of your own organisation will depend on your own particular circumstances. We cannot do more here than indicate some broad directions and offer some general guidelines. For details, we refer you to the Australian Tax Office (ATO) help sheets . They're somewhat dry and legalistic and not always clear, but it's impossible to rewrite them to be clearer without rendering them less accurate. If you're still not sure about where you stand after looking at the ATO help sheets, there's no way around it: you'll have to go to a specialist lawyer. That's why we have them.

Legal structures

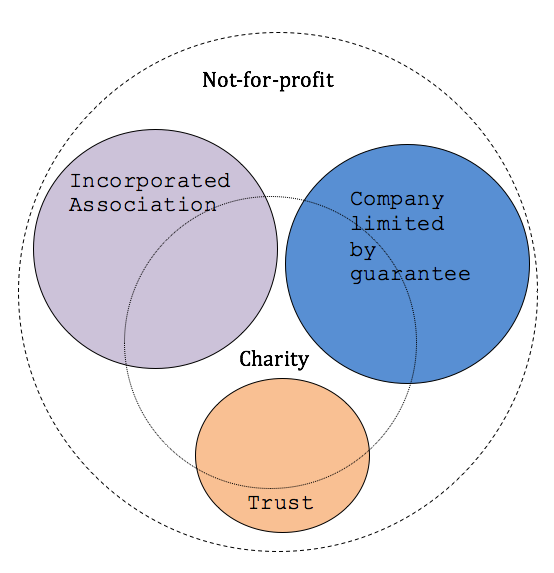

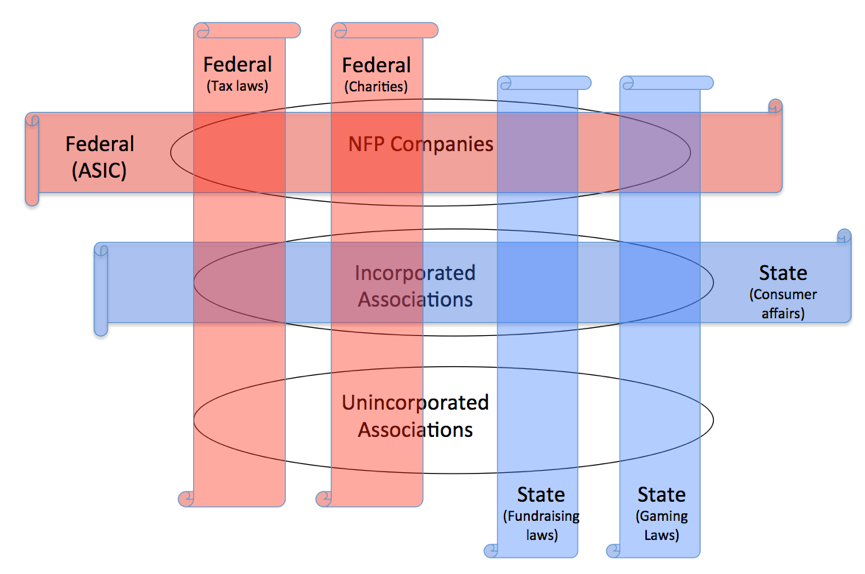

Australian not-for-profits can choose to be any one of a bewildering number of legal entities. Possible forms include unincorporated associations, incorporated associations, companies limited by guarantee, trusts and cooperatives.

Each of these has different regulators and different governance systems.

Tax classifications and charity status

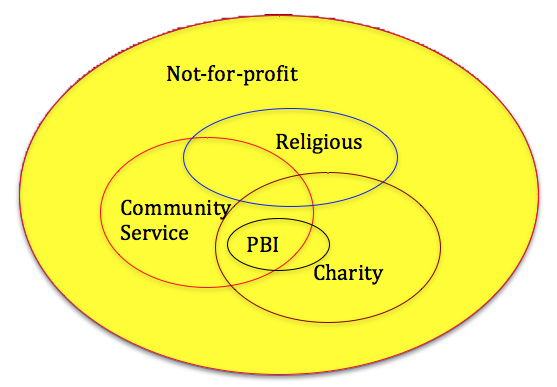

That's bad enough, but laid on top of these classifications, and independent of them, is a completely separate layer of tax classifications - public benevolent institutions (PBIs), charities, non-charitable not-for-profits.

You can't decide for yourself which of these you want to be; either you are or you aren't.

All PBIs are charities, but not all charities are PBIs. All charities are not-for-profits, but not all not-for-profits are charities.

Your tax liabilities depend on which classification (and sometimes sub-classification) your organisation falls into.

For federal taxes, you may (depending on your status) be eligible for partial or total exemption from income tax, fringe benefits tax (FBT) and goods and services tax (GST).

Those are the taxes that you pay as an organisation. You also have to pay taxes on behalf of your employees, holding back some of their pay and sending it off to the ATO. You may have income tax exemption, but they don't, and you're not exempt from paying it for them.

DGR status

The ATO also decides whether donations to your organisation will be tax-deductible for your donors. If they are, then you are what is known as a deductible gift recipient (DGR). The ATO account of DGR status can be found here. It's all pretty arbitrary, very complicated indeed, and doesn't directly correlate with any of the other classifications. If you want DGR status you're definitely going to need to go to a specialist lawyer - preferably before you even set up your organisation, because a lot depends on the exact wording of your objectives.

Other tax exemptions

You may also be able to get exemptions from some state and municipal taxes and charges such as payroll tax, stamp duty, and car registration fees. For these you'll have to consult the relevant authorities in each state.

More information

For further information from the ATO, see: